Cost Basis:

What It Means, Examples and Calculation

What you need to know to help minimize your taxes when selling investments.

At A Glance

Choose a Method

It’s up to taxpayers to choose the cost basis method when reporting sales of investments to the IRS.

Know the Difference

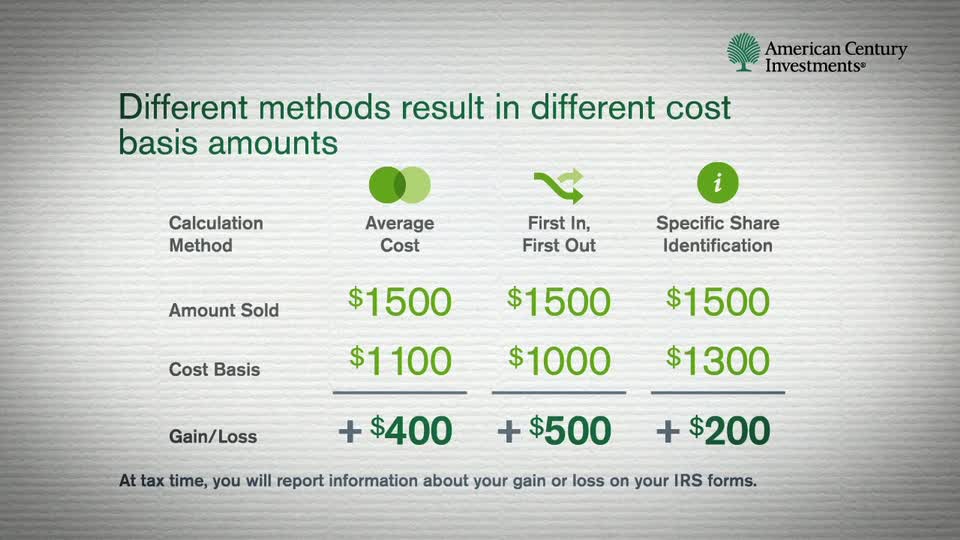

Different cost basis methods can change how much gain or loss you report, which may affect your tax bill.

Keep Good Records

Storing important documents and knowing what adjusts cost basis may lead to lower taxes and better returns on investments.

When the end of the year approaches, investors who want to make smart moves to reduce their tax burdens often take a closer look at the adjusted cost basis for investments, including mutual funds, exchange-traded funds (ETFs), stocks, bonds, cryptocurrencies and real estate.

You don’t have to wait until it’s time to file your taxes to begin cost basis management though. If you know what adjusts cost basis and how to use it in calculating your investment taxes, long-term planning can help you determine the best ways to minimize the amount of capital gains taxed.

Tax-savvy investors can include cost basis considerations in their investment decisions to help reduce their tax bills.

If you have investments in a taxable, non-money market account at American Century Investments®, then you can log in to your account and select the “Choose your cost basis method” link from the My Profile page. Or print and return the Cost Basis Election Form.

Have cost basis questions related to your American Century account? Jump to the Q&A below.

What Is Cost Basis?

Generally, cost basis is the price you paid for a security, including any applicable commissions and expenses. You use cost basis to determine whether you have a gain or a loss when you sell an investment. If the selling price is greater than your cost basis, your profit is called a gain. If the selling price is less than the cost basis, your deficit is called a loss.

The difficult part is figuring out your adjusted cost basis, as you might have invested money in your asset at different times or experienced a cost-adjusting event.

What Is Your Adjusted Cost Basis?

Certain investment types have unique aspects that will adjust your cost basis while you hold the investment. Here are some common adjustments.

Why Is Cost Basis Important for Taxes?

Your cost basis determines your potential gains and losses and, therefore, the taxes you may owe when you sell investments. You—the taxpayer—are responsible for accurately reporting your cost basis information to the IRS.

Yet, the government is vested in ensuring your reported costs are accurately calculated because it affects your taxes. Therefore, Congress created laws requiring financial service companies to track and report cost basis to the IRS and to taxpayers for taxable accounts beginning in 2012 for stocks, in 2014 for bonds, and in 2021 for cryptocurrencies.

Planning Pointer

Your elected cost basis methods are critical to many financial decisions, including:

- What securities and lots to sell, which impacts your income tax liability.

- What shares to give to others when gifting to your children and family members.

- What shares to donate to charities to satisfy your charitable and philanthropic inclinations.

Consider working closely with your tax advisor and investment advisor to ensure your decisions are appropriate for your personal situation.

Hypothetical Cost Basis Calculation Examples

For comparison, we describe below how mutual fund cost basis is determined using three primary methods with the same purchase/sell dates.

As you calculate potential gains and losses through these cost basis method considerations, you can help determine which option is best for your investment portfolio.

Date of Transaction | Transaction | Amount | Price Per Share | Number of Shares | Total Shares |

6/15/2022 | Purchase | $5,500 | $11 | 500 | 500 |

5/15/2023 | Reinvest Dividend | $240 | $12 | 20 | 520 |

06/15/2023 | Purchase | $7,000 | $14 | 500 | 1020 |

Total Amount Invested | $12,740 | 1020 | |||

07/01/2023 | Sell | $290 | $14.50 | 20 | 1000 |

Tax-Saving Cost Basis Strategies

Your choice of cost basis method is a tax planning strategy in itself. The specific-share ID method gives the most flexibility and control over the shares you choose to sell, give or donate. It also requires careful recordkeeping; financial software may offer you an easy way to track it. A couple of tax strategies investors use regarding cost basis include:

Loss/Gain Utilization

You dispose of shares with losses before the shares with gains consistent with minimizing potential taxable gains. When dealing with gains, the focus is on selling shares with a higher cost basis. Note that this method does not take the holding period into consideration, hence the higher cost shares could be held by you for one year or less and potentially subject to a higher short-term capital gain tax rate.

Time and Holding Period Management

If the share price has appreciated, using shares that have been held for more than one year may be taxed at the preferred long-term capital gains tax rate. If the price has depreciated, using shares that have been held for one year or less could offset other short-term gains you’ve realized.

Tax-Efficient Portfolio Moves

Investors also may find tax savings by keeping an eye on their overall investment mix through the following.

Tax-Loss or Gain Harvesting

A popular year-round tax strategy, tax-loss harvesting involves reducing your tax bill by selling shares at a loss to offset realized gains from other investments. It may also entail selling shares to realize gains (gain harvesting) and offsetting realized losses you may have.

What if you want to sell a security for tax purposes but still like the investment’s long-term prospects? You’ll want to be mindful of the wash-sale rule, which states that you can’t purchase the same or substantially identical shares within 30 days before or 30 days after a sale since the loss would be disallowed.

Asset Allocation and Location

How you divide your assets among different asset classes can impact your tax bill. For example, stock dividends are generally taxed more favorably than interest income from traditional bonds, so if you are in a high tax bracket, you may want to have more of your investments in taxable accounts. ETFs also tend to have superior tax efficiency relative to mutual funds.

Tips for Not Overpaying on Investment Taxes

Keeping an eye on the tax consequences of your decisions throughout the year may save you money when you file your taxes. While the IRS gives you flexibility in how you calculate your cost basis, it’s up to you to have the documentation to back it up.

These are just some of the ways to manage taxes on investments. Your tax preparer and financial professional may have more tips suited to your particular situation.

Q&A for American Century Clients

Looking to Keep More of What You Earn?

Get more information about how tax rules affect your investments.

Long- and short-term capital gains are taxed at different rates. Long-term gains may only be offset by longer-term losses. Likewise, short-term gains may only be offset by short-term losses.

IRS Circular 230 Disclosure: American Century Companies, Inc. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with American Century Companies, Inc. of any of the matters addressed herein or for the purpose of avoiding U.S. tax-related penalties.

This information is for educational purposes only and is not intended as tax advice. Please consult your tax advisor for more detailed information or for advice regarding your individual situation.

This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

Giftrust® is an irrevocable trust designed to be given as a long-term gift to someone other than yourself or your spouse and is not available for an IRA. The Giftrust investment is invested in the Growth fund.